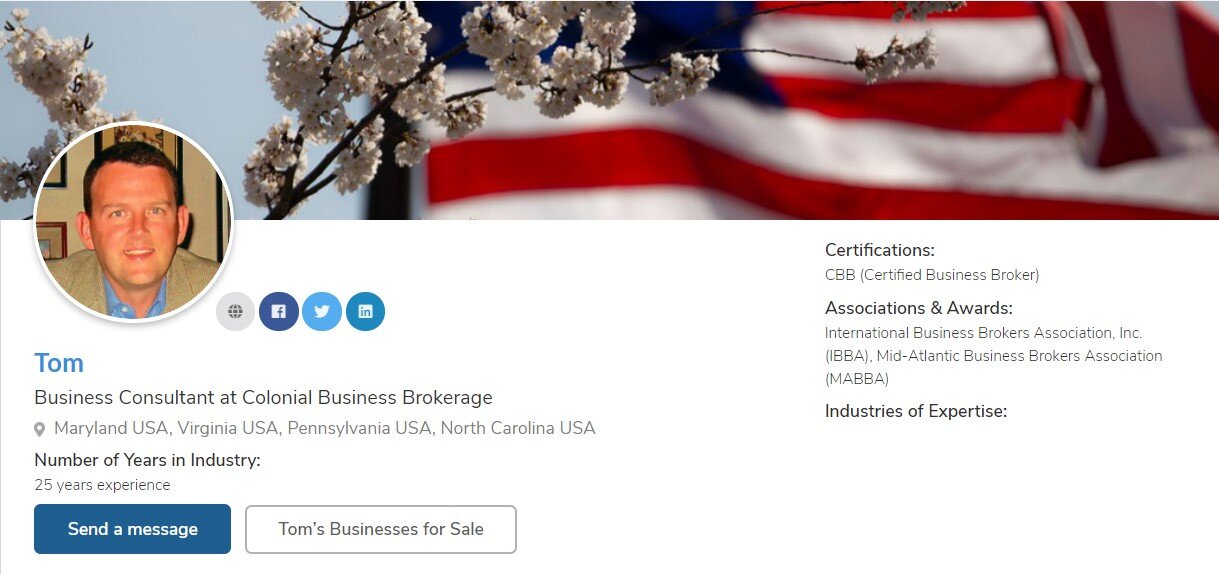

From the Trenches - Interview With Maryland Business Broker Tom Flowers

Tom Flowers

Current market perspective from the trenches of the business acquisition & sale industry

Sit-Down Interview With Business Broker Tom Flowers

What are your thoughts on where business acquisition & sale market activity is heading over the next 3-6 months?

Lower middle-market M&A has certainly come to a standstill as a result of the Coronavirus crisis. Companies that would typically be strategic buyers have been forced to focus their energy towards their own companies and away from pursuing growth and acquisition opportunities. The same goes with the private equity folks. They've been forced to spend time on their existing portfolio companies at the expense of new deal activity.

Of course, certain industries have been affected more than others; such as travel and leisure, transportation, and oil and gas. These industries may see upticks in M&A activity later this year as buyers see opportunities for bargains in these sectors. And while the existing M&A pipeline is thin, the percentage of transactions involving rescue deals, restructurings, and distressed sellers will likely increase, both in dollar terms and as a percentage of overall M&A activity.

Negotiations will take longer. Due diligence will take longer, many more issues to resolve now. Third-party consents (such as from landlords, customers, and licensors) will take longer to obtain. There will be delays in obtaining any necessary licensing, antitrust, or other regulatory approvals. M&A agreement terms will take longer to negotiate. Valuations from comparable transactions, even those entered into very recently will likely be no longer applicable. Buyers requiring financing will encounter delays. Buyers and their boards of directors are going to be much more cautious, and internal justifications for deal-making in this environment will need to be more compelling.

What do you see as the most significant SELF-IMPOSED threats out there that could hurt the market for business acquisition & sale and small business activity in general?

Due diligence. Buyers/Acquirers now have significant additional due diligence items to assess based on the effect of the COVID-19 crisis on a seller's business.

What do you see as the top three things the government needs to do to support main street business acquisition and sale opportunities for small business owners through the remainder of this year?

Open without restrictions.

Stimulate economic rebound.

Encourage small business activity.

What do you see as the top three reasons to BUY a business in 2020?

Immediate cash flow from day one.

Existing customer base and brand in place.

Financing programs available.

What are some of the questions a business owner should ask when choosing an advisor to help buy a business or work on exit planning to help navigate through this challenging stretch?

Business owners should ask advisors the following questions:

How much experience do you have selling businesses like mine?

How many like mines have you sold?

Confidentiality measures in place?

Do you have qualified buyers for my business?

How many listings do you currently have?

Do you work from home or the office?

How many businesses like mine have you sold?

How will you prevent my customers and competitors from hearing my business is for sale?

How many qualified buyers do you have?

How would you rate the current political environment related to small business growth, business acquisition & sales?

5/5

What are your thoughts on transaction terms for buyers & sellers in the current market?

What I have been seeing for businesses that will certainly be back up and running when we’re fully reopened are deals that are a little more creative. Meaning that while the business should be worth close to what it was pre-COVID-19, in order for an owner to realize that value, contingencies like earn-outs and revenue targets post-reopen are worked into the deal in order to make the Buyer feel more at ease.

Thoughts on business valuations in today's market?

COVID-19 has certainly played a role in valuation questions in today's market. For very good, well-run businesses, that will be up and running at full capacity once the nation is fully reopened, there shouldn't be too much of a hit to the valuation. Although deals for those businesses may need to be more creative in terms and structure to make the buyers feel more at ease.